From Signals to Systems: Building a Discovery Engine

Why continuous learning beats periodic research

🎧 Also a Podcast Conversation

Check out the latest episode of The Product Leader's Playbook, where our AI hosts explore why most teams confuse research theater with systematic discovery, break down the four-layer framework that transforms sporadic customer input into continuous competitive advantage, and discuss how to build discovery infrastructure that scales across teams and survives organizational changes.

→ 🎙Listen now on Spotify, Apple Podcasts, YouTube, or Amazon Music

"Truth is the daughter of time, not of authority."

— Francis Bacon

The Discovery Delusion

Product teams love the concept of customer discovery. They schedule user interviews during planning sprints, design feedback forms for feature launches, and occasionally commission market research studies. But two weeks into execution, the urgency of delivery overwhelms the discipline of learning. Stakeholders demand velocity. Engineers need clear requirements. And without systematic infrastructure, discovery becomes something you did once instead of something that shapes how you work.

The result is predictable. Research artifacts that lose relevance within months. Roadmap decisions anchored in assumptions that were never validated. Customer feedback that arrives too late to influence the features already in development. Teams shipping solutions to problems they understood six months ago while missing the opportunities emerging today.

This isn't a motivation problem. Product teams care deeply about customer needs. This is an infrastructure problem. Teams treat discovery like project kickoffs instead of operational systems. They optimize for occasional insight rather than continuous learning. They mistake research activities for discovery capabilities.

If your product decisions can't trace back to recent customer evidence, you're building on quicksand.

Why Discovery Systems Beat Discovery Events

The distinction between discovery research and discovery systems determines whether customer insight creates sustainable competitive advantage or becomes organizational theater.

Discovery research treats customer learning as a discrete project phase. You conduct interviews before building features. You run surveys after launches underperform. You gather feedback when stakeholder pressure demands validation. Between these episodes, product decisions rely on intuition, internal debate, and whoever argues most persuasively in planning meetings.

Discovery systems treat customer learning as continuous infrastructure. Signal collection happens automatically through embedded processes. Insight synthesis occurs through recurring rituals that surface patterns across multiple sources. Product decisions connect systematically to evidence streams that update constantly rather than research snapshots that age quickly.

The operational difference is profound. Teams with discovery research can tell you what customers said last quarter. Teams with discovery systems can tell you what customers are experiencing this week, which behaviors are changing, and which assumptions need updating based on recent evidence.

Research shows this performance gap is significant. Teresa Torres found that teams conducting weekly customer interviews consistently outperform peers on product success metrics, achieving 23% higher feature adoption rates and 31% faster time to market for successful products. Yet fewer than 15% of product teams maintain continuous discovery cadences. The rest rely on periodic research that quickly becomes outdated.

The Hidden Cost of Episodic Discovery

When discovery happens in isolated events rather than continuous streams, insights decay faster than teams realize. Customer behavior evolves. Competitive features reshape expectations. Market conditions change usage patterns. Early research loses predictive value as context shifts.

Consider the typical discovery failure mode. A team conducts comprehensive user interviews during Q1 planning, generating detailed personas and journey maps. By Q3, those insights are shaping feature decisions for Q4 delivery. The team ships based on customer needs that were current nine months earlier, missing the problems that matter today.

This creates a systematic lag between customer reality and product strategy. Teams become confident in their customer understanding while building solutions that address yesterday's problems. The research was excellent. The timing was wrong.

A mid-stage B2B software company eliminated this lag by implementing continuous signal tagging across sales calls, support tickets, and user interviews. Instead of quarterly research projects, they built structured insight capture into daily operations. Customer signals were tagged, synthesized monthly, and linked directly to product decisions.

The results were measurable. Feature validation time decreased by 41% because assumptions could be tested against recent evidence rather than stale research. Product-market fit conversations became more precise because customer feedback streams provided real-time signals on messaging and positioning. Most importantly, the team could pivot quickly when customer needs shifted because they had current data rather than historical studies.

The insight: periodic research optimizes for comprehensive understanding at single points in time. Systematic discovery optimizes for current understanding that updates continuously.

The Discovery Engine Framework

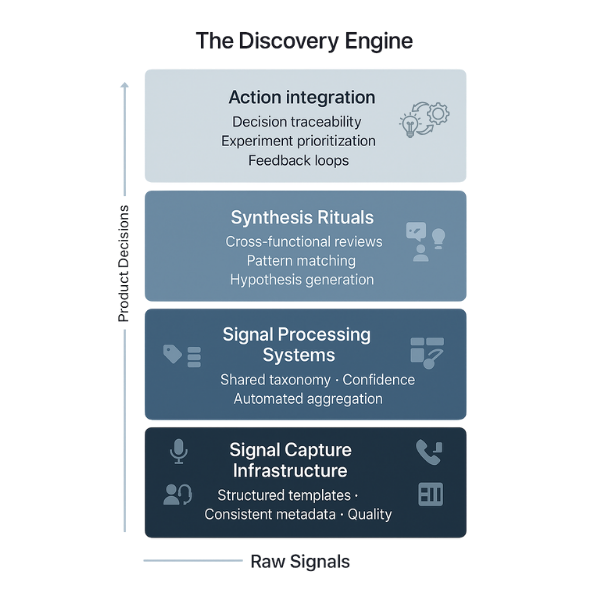

Effective discovery requires infrastructure that transforms random customer input into systematic competitive advantage. This means building what I call a Discovery Engine: a four-layer system that captures signals continuously, processes them systematically, and applies them to product decisions reliably.

The Discovery Engine operates on a simple principle. Customer truth emerges through accumulated evidence over time, not through authoritative research at discrete moments. Teams need infrastructure that makes signal collection automatic, pattern recognition routine, and evidence application inevitable.

Layer 1: Signal Capture Infrastructure

The foundation layer establishes consistent methods for gathering customer signals from multiple sources. This includes structured templates for user interviews, standardized tagging systems for support interactions, and integration points that surface usage patterns during normal workflow.

Effective signal capture requires more than good intentions. It requires shared vocabulary across sources, consistent metadata that enables comparison, and quality thresholds that distinguish meaningful signals from noise. Most importantly, it requires embedding insight collection into processes that already happen rather than creating new overhead.

Stripe exemplifies systematic signal capture. Customer success calls include mandatory insight tagging. Support tickets route through classification systems that identify product gaps. User interviews follow structured templates that generate comparable data across sessions. The infrastructure makes signal collection a byproduct of customer interaction rather than an additional burden.

Layer 2: Signal Processing Systems

The second layer normalizes signals from different sources into comparable intelligence. Raw interview transcripts, support ticket summaries, and usage analytics need common structure before they can reveal patterns.

Processing systems include shared taxonomies that classify different signal types, confidence scoring that distinguishes validated insights from preliminary observations, and automated aggregation that surfaces trends across large data sets. The goal is transforming individual signals into systematic intelligence.

Without processing systems, discovery efforts generate insight fragmentation. Interview findings live in research folders. Support insights exist in ticket systems. Usage patterns stay in analytics dashboards. Teams accumulate customer data but struggle to synthesize customer understanding.

Layer 3: Synthesis Rituals

The third layer creates recurring opportunities to interpret signals and generate hypotheses about customer behavior. This includes cross-functional insight reviews, pattern matching across data sources, and explicit connection between evidence and product decisions.

Synthesis rituals must balance efficiency with thoroughness. Monthly reviews provide sufficient frequency without creating meeting overhead. Cross-functional participation ensures diverse perspectives on signal interpretation. Structured agendas force teams to move from observation to hypothesis to action within time constraints.

Linear demonstrates effective synthesis through their weekly customer signal reviews. Product, design, engineering, and customer success examine patterns across support tickets, user feedback, and usage analytics. Each session produces three outputs: validated insights, testable hypotheses, and specific next actions. The ritual transforms data accumulation into decision-making intelligence.

Layer 4: Action Integration

The final layer connects insights systematically to product choices. This includes traceability systems that link roadmap decisions to supporting evidence, experiment prioritization based on customer signals, and feedback loops that track whether insights translate into successful outcomes.

Action integration prevents discovery from becoming elaborate research theater. If customer insights never influence actual product decisions, the discovery system becomes organizational overhead rather than competitive advantage. Teams need explicit processes that ensure evidence shapes strategy rather than merely supporting predetermined choices.

The most effective teams maintain decision journals that document the customer evidence supporting each roadmap choice. When features succeed or fail, they can trace outcomes back to the insights that motivated investment. This creates organizational learning that improves both discovery systems and product judgment over time.

Implementation: Building Your Discovery Engine

Discovery systems succeed through systematic implementation rather than heroic effort. The following 90-day framework transforms sporadic customer input into continuous competitive intelligence.

Days 1-30: Foundation and Signal Selection

Begin by auditing existing customer touchpoints rather than creating new research processes. Most teams already have multiple signal sources: user interviews, support tickets, sales calls, usage analytics, churn exit interviews. The problem isn't lack of signals. The problem is lack of system.

Select two or three highest-fidelity sources to systematize first. User interviews and support tickets typically provide the richest qualitative signals. Usage analytics provide quantitative validation. Sales calls surface market-level patterns. Choose sources that generate regular signal volume and provide access to different customer perspectives.

Create shared infrastructure using tools your team already understands. Notion databases, Airtable bases, or dedicated customer research platforms work well. The specific tool matters less than consistent usage and shared access. Build capture templates that include required metadata: signal type, customer segment, confidence level, potential impact, and urgency classification.

Days 31-60: Processing and Synthesis

Establish synthesis rituals that surface patterns without creating meeting overhead. Monthly cross-functional reviews typically provide optimal balance between frequency and efficiency. Include product, design, engineering, and customer-facing roles to ensure diverse signal interpretation.

Create structured agendas that move systematically from observation to action. Review signal patterns across sources. Generate testable hypotheses about customer behavior. Identify validation experiments or additional research needed. Connect insights to current roadmap decisions. Assign specific next actions with clear ownership and timelines.

Build traceability between insights and product decisions. Use simple tracking systems that link roadmap items to supporting customer evidence. When prioritizing features, explicitly identify which customer signals justify investment. When launching experiments, document which hypotheses are being tested. This creates accountability for evidence-based decision making.

Days 61-90: Integration and Optimization

Connect discovery systems to existing product operations rather than creating parallel processes. Roadmap planning should include customer signal reviews. Sprint planning should reference recent user feedback. Launch retrospectives should examine whether customer assumptions proved accurate.

Measure system health through leading indicators rather than satisfaction surveys. Track signal volume and quality trends. Monitor time from insight capture to synthesis. Measure percentage of product decisions linked to recent customer evidence. These metrics reveal whether discovery infrastructure creates decision-making advantage or merely generates research artifacts.

Optimize based on evidence rather than intuition. If synthesis meetings produce insights that never influence decisions, examine whether the wrong people are participating or the right decisions are being discussed. If signal capture generates low-quality data, refine templates and training rather than collecting more volume. If insights don't connect to roadmap choices, strengthen the traceability systems rather than conducting more research.

Scaling Discovery Across Teams and Time

Discovery systems must evolve as organizations grow from single product teams to multiple product lines to platform companies serving diverse markets. The principles remain constant, but the infrastructure needs become more sophisticated.

Multi-Team Coordination

As companies scale beyond individual product teams, discovery systems need shared infrastructure that enables both specialized insight and cross-team learning. Platform decisions require customer signals from multiple product lines. Shared service investments need evidence from diverse user segments. Competitive intelligence benefits from company-wide signal aggregation.

Effective scaling requires standardized signal taxonomies that enable comparison across teams while preserving context-specific insights. Shared repositories that surface relevant signals to the right decision makers. Cross-team synthesis sessions for decisions that affect multiple products. Centralized competitive intelligence that informs individual product strategies.

Organizational Memory and Transitions

Discovery systems must preserve institutional memory through team changes and strategic pivots. Unlike individual research studies that become outdated, systematic discovery creates compound organizational intelligence that improves decision-making over years rather than quarters.

This requires documentation standards that capture not just what customers said, but why insights mattered and how they influenced decisions. Version control for customer understanding that tracks how assumptions evolved based on new evidence. Decision genealogy that connects current strategy to historical customer learning.

Teams with strong discovery systems make better decisions during leadership transitions because customer knowledge exists in accessible systems rather than individual memories. New team members can understand customer context quickly by reviewing systematic evidence rather than reconstructing insights through scattered interviews.

Common Failure Modes and Solutions

Discovery systems fail predictably when teams optimize for research quality rather than systematic insight generation. The following failure modes derail most implementation efforts.

Signal Overload: Collection Without Synthesis

Teams often assume more customer data automatically creates better customer understanding. They implement comprehensive signal capture across all touchpoints but lack systematic synthesis processes. The result is insight abundance but decision paralysis.

The solution is focusing on decision-relevant signals rather than comprehensive documentation. Before capturing any signal, identify which product decisions it could influence. If a signal type rarely affects roadmap choices, reduce collection priority. If synthesis meetings generate insights that never drive action, examine whether you're discussing the right topics or including the right participants.

Heroic Discovery: Individual Ownership Instead of System Infrastructure

Many teams assign customer discovery to individual researchers or product managers rather than building shared systems. When key individuals leave or become unavailable, discovery efforts collapse because knowledge and processes exist in personal workflows rather than organizational infrastructure.

Building resilient discovery systems requires distributing both signal collection and synthesis responsibilities across multiple team members. Customer-facing roles should contribute insights during normal work rather than conducting separate research activities. Cross-functional synthesis ensures diverse perspectives and shared ownership of customer understanding.

Research Theater: Perfect Studies That Never Influence Decisions

The most sophisticated failure mode occurs when teams conduct excellent research that generates impressive artifacts but never influences actual product choices. These teams can demonstrate extensive customer knowledge while making decisions based on internal assumptions and stakeholder pressure.

Preventing research theater requires explicit traceability between customer evidence and product decisions. Every roadmap choice should reference supporting customer insights. Every feature launch should test hypotheses derived from systematic discovery. When research fails to influence decisions, examine whether the right questions are being asked or the right people are participating in synthesis.

Competitive Advantage Through Discovery Infrastructure

The most successful product companies use discovery systems as competitive differentiation rather than internal process improvement. While competitors conduct periodic research studies, companies with systematic discovery infrastructure generate customer intelligence faster and more reliably.

This creates compound advantages that become increasingly difficult to replicate. Better customer understanding leads to more successful product bets. Successful products generate more customer interaction opportunities. More customer touchpoints create richer signal streams. Richer signals enable faster learning cycles and better subsequent decisions.

Amazon exemplifies competitive advantage through systematic discovery. Their customer obsession principle manifests through infrastructure rather than just culture. Customer anecdotes are required in product reviews. Working backwards from press releases forces customer problem validation before solution development. Systematic measurement connects customer outcomes to business metrics rather than relying on satisfaction surveys.

These systems generate decision-making advantages that competitors cannot replicate through better research or more customer interviews. The advantage lies in systematic insight generation that compounds over time rather than episodic intelligence that becomes outdated quickly.

Making the Business Case: Discovery as Investment, Not Overhead

Executives often view discovery systems as process tax that slows shipping velocity. The business case requires reframing discovery infrastructure as decision-making acceleration rather than research burden.

The upfront investment is measurable but modest. Implementing a basic discovery system requires approximately 40 hours of product team time over 90 days: 15 hours for infrastructure setup, 20 hours for monthly synthesis meetings, 5 hours for system optimization. The ongoing cost is roughly 3 hours per month for cross-functional synthesis reviews.

The returns compound quickly. Teams with systematic discovery reduce feature rework by 25% because they validate assumptions before building. They achieve product-market fit 30% faster because they can test positioning and messaging against current customer signals rather than stale research. Most importantly, they make strategic pivots based on evidence rather than internal debate, reducing the cost of wrong bets.

Present discovery systems to leadership as competitive intelligence infrastructure. While competitors conduct quarterly research studies, you generate customer insights weekly. While they validate assumptions after launch, you test hypotheses before development. The velocity advantage creates market positioning that becomes increasingly difficult to replicate.

Integration with Product Operations

Discovery systems work best when embedded into existing product processes rather than creating parallel workflows. Your Strategy Stack connects vision to backlog decisions through strategic pillars. Discovery systems provide the customer evidence that validates whether strategic choices solve real problems.

During quarterly roadmap planning, synthesis reviews surface customer signals that support or challenge strategic priorities. Monthly business reviews include discovery metrics alongside product performance indicators. Weekly sprint planning references recent user feedback to inform feature prioritization and scope decisions.

The Prioritization Portfolio approach allocates capacity across growth, quality, platform, and research investments. Discovery systems inform allocation decisions by revealing which customer problems deserve disproportionate attention and which assumptions need validation before major investment.

This integration prevents discovery from becoming isolated research activity. Instead, customer signals become systematic input to strategic decision making, resource allocation, and execution planning that already occur.

Building Your Discovery Infrastructure

Effective discovery infrastructure requires specific components that transform random customer input into systematic competitive intelligence. Signal capture templates should include required fields: source type, customer segment, signal classification (pain/need/behavior), confidence level (high/medium/low), potential impact, and decision relevance.

Monthly synthesis agendas should follow a consistent structure: pattern review across sources, hypothesis generation from customer signals, validation planning for key assumptions, roadmap connection decisions, and next action assignments. System health dashboards should track signal volume, synthesis frequency, and insight-to-decision conversion rates.

Decision traceability systems should link roadmap items to supporting customer evidence, ensuring that product choices connect systematically to recent signals rather than historical research or internal assumptions. These components work together to create discovery infrastructure rather than just discovery activities.

From Research Events to Intelligence Infrastructure

Most product teams approach customer discovery like project management rather than competitive intelligence. They schedule research activities during planning phases, gather comprehensive insights at discrete moments, and struggle to maintain current customer understanding as market conditions evolve.

Discovery systems transform this approach by treating customer intelligence like technical infrastructure. Signal collection happens continuously through embedded processes. Insight synthesis occurs through recurring rituals that surface patterns systematically. Product decisions connect reliably to evidence streams that update constantly.

The teams building successful products in competitive markets have moved beyond episodic research to systematic discovery. They generate customer intelligence faster than competitors can conduct studies. They validate assumptions in days rather than quarters. They pivot strategies based on current evidence rather than historical research.

Your discovery system determines your decision-making velocity. The only question is whether you'll build it systematically or keep hoping that good research will create good insights.

Discovery is not a research project. Discovery is competitive infrastructure. The teams that understand this distinction don't just learn about customers faster. They win in markets where customer understanding creates sustainable advantage over technical capabilities or resource advantages alone.

Build your discovery engine. Your customers will feel the difference in products that solve their actual problems. Your competitors will struggle to understand how you move so quickly from customer insight to market-winning solutions.

🎧 Want to Go Deeper?

This article is discussed in a podcast episode of The Product Leader's Playbook, streaming everywhere:

🔹 Spotify | 🔹 Apple Podcasts | 🔹 YouTube | 🔹 Amazon Music